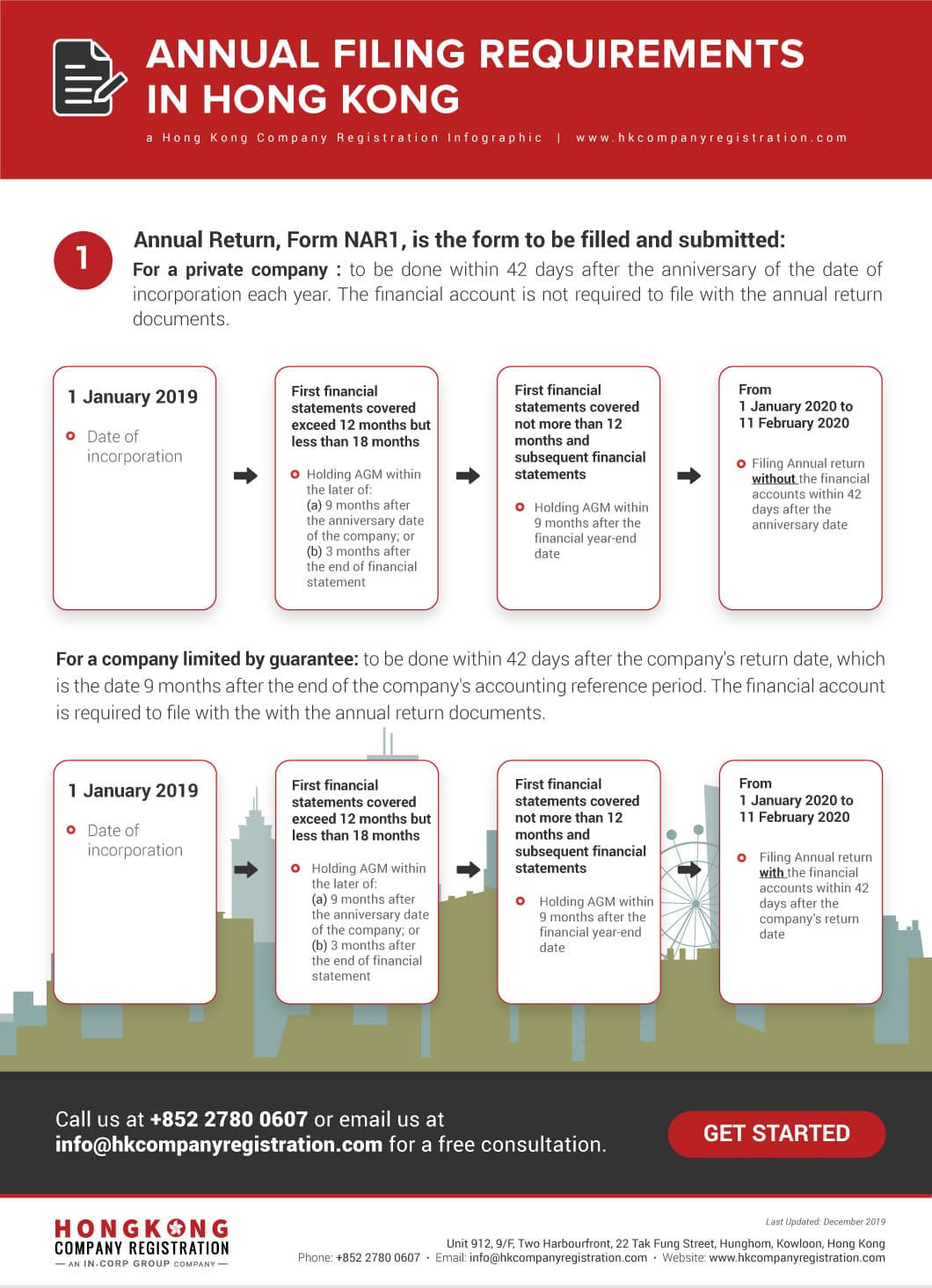

All Hong Kong incorporated companies are required to file an annual return. This applies both to local companies branch and subsidiaries of a foreign company. Form NAR1 is to filled and submitted to the Inland revenue department and the companies registry. Below Infographics will help you understand the Annual Filing Requirements and Deadlines for Private limited company and company limited by guarantee.

What is a NAR1 Form?

The NAR1 form, also known as the Annual Return form, is a document that needs to be submitted to the Hong Kong Companies Registry on an annual basis. It provides important details about your company, such as shareholder and director information, registered address, and an overview of operations.

The NAR1 form is prepared by your appointed Company Secretary, who is responsible for ensuring your company’s compliance with Hong Kong’s corporate laws. They collate, sign, certify, and submit the information included in the annual return on your behalf.

The submission of the NAR1 form is mandatory, even if there have been no changes to your company’s fundamental information. It is due within 42 days of your company’s initial incorporation, and the deadline remains the same each year.

The annual fees for submitting the NAR1 form vary depending on the type of company:

- Public Company: HK$140

- Company Limited by Guarantee: HK$105

- Private Company: HK$105

You can submit your annual return in various ways. One option is to deliver a hard copy of the completed NAR1 form by mail or in person. Another option is to use the electronic filing service provided by the Companies Registry, which is accessible 24/7.

Below is the infographic on the annual filing requirements in Hong Kong.

Get hassle-free accounting and tax service

With us, you can rest assured that our qualified accountants will go the extra mile and do what it takes to get the job done well, allowing you to hae the peace of mind and focus on growing your business.